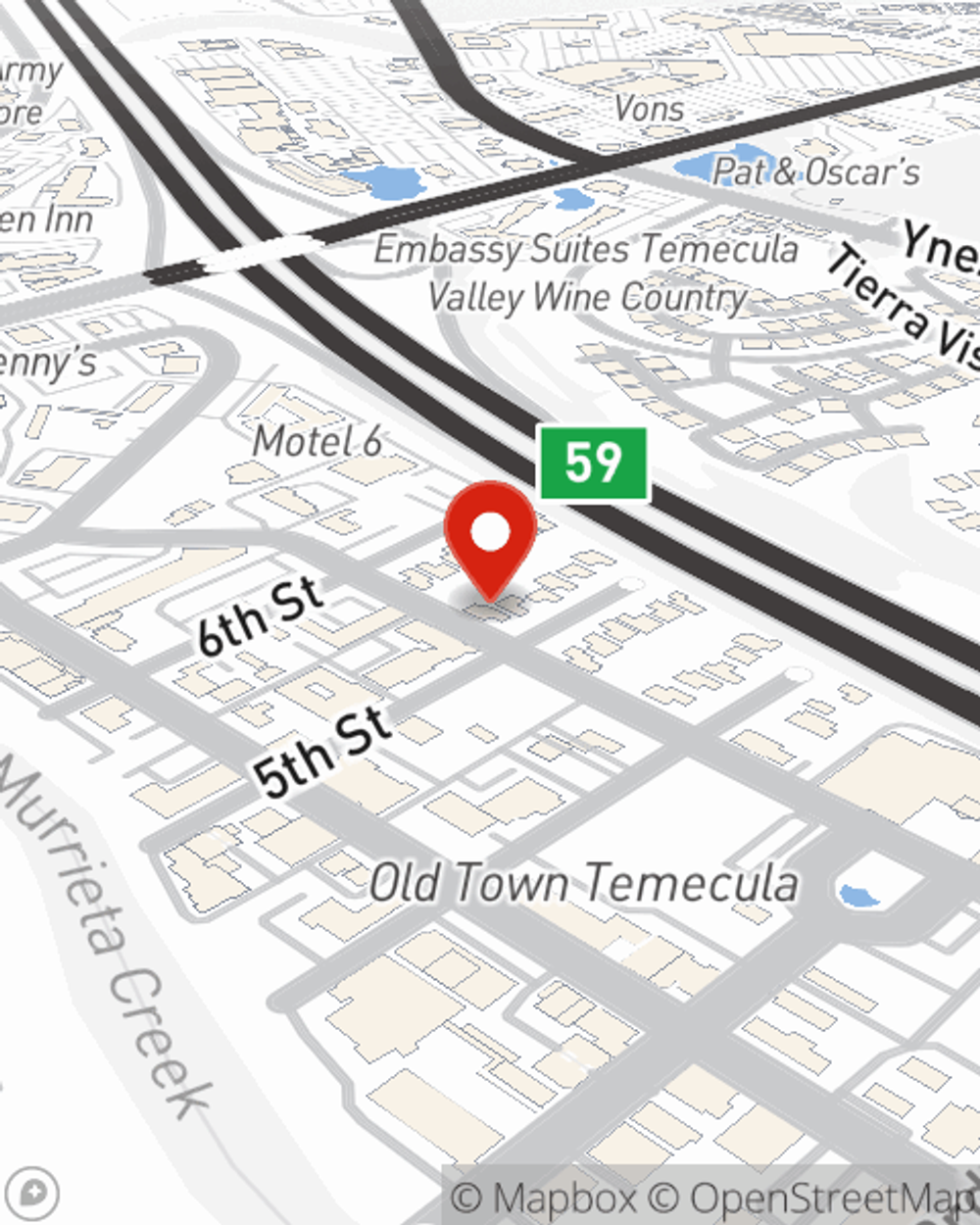

Condo Insurance in and around Temecula

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Calling All Condo Unitowners!

There is much to consider, like providers savings options, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a complicated decision. Not only is the coverage incredible, but it is also competitively priced. And that's not all! The coverage can help provide protection for your condominium and also your personal property inside, including things like books, linens and furnishings.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Agent Julie Ngo, At Your Service

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Julie Ngo can be there whenever the unexpected happens to help you submit your claim. State Farm is there for you.

As a commited provider of condo unitowners insurance in Temecula, CA, State Farm helps you keep your belongings protected. Call State Farm agent Julie Ngo today and see how you can save.

Have More Questions About Condo Unitowners Insurance?

Call Julie at (951) 695-2625 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.